Financing the future of supercomputing: advisory study by the European Investment Bank

02/07/2018

The results of this study prepared by the European Investment Bank on behalf of the EC DG Research and Innovation and DG Connect are available. The authors had interviews with some ETP4HPC office members and with some of our members.

"European supercomputing infrastructure represents a strategic resource for the future of EU industry, SMEs and the creation of new jobs"

Mariya Gabriel, Commissioner for Digital Economy and Society

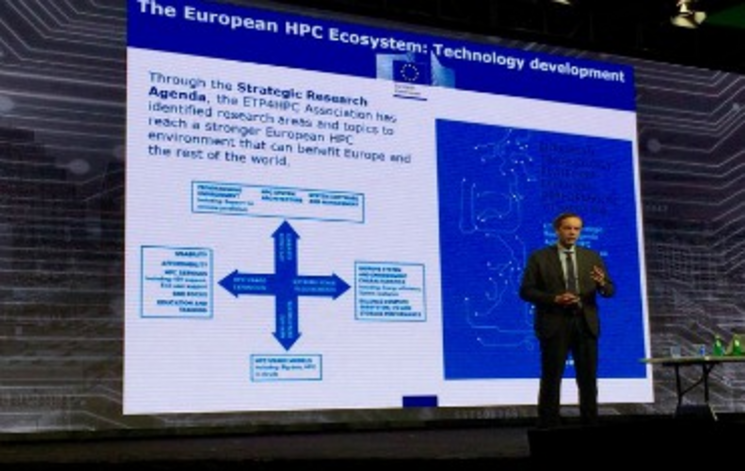

Finding 1: Demand for HPC capabilities is rapidly increasing in key sectors of the European economy, such as aerospace, automotive, energy, manufacturing and financial services, while Europe’s more ‘traditional’ SMEs are lagging behind.

Finding 2: Fragmentation and limited coordination at the EU level has resulted in a suboptimal investment climate and an underinvestment in strategic HPC infrastructures in Europe.

Finding 3: Most European HPC centres are largely publicly financed and owned, and dedicated to research. More commercially oriented HPC centres and activities within public HPC centres are emerging, but are often hampered by rules and regulations.

Finding 4: Key Stakeholders (from HPC centres to HPC customers) in the European HPC ecosystem face different financial challenges that need tailored solutions.

Finding 5: HPC intermediaries represent a key link between HPC infrastructure and customers, able to further catalyse commercial exploitation by matching supply with demand.

Finding 6: Demand for HPC services among SMEs is not only constrained by the limited knowledge of the benefits of HPC, but also by a lack of finance to invest.

Finding 7: Independent Software Vendors (ISVs) are crucial actors in European HPC. However, ISVs have difficulties in accessing finance.

Finding 8: Private investors are already engaged in the financing of commercial HPC infrastructure (especially HPC centres), but not in public HPC infrastructure with limited ‘bankability’ prospects.

Recommendation 1: Increase financial support from the public sector for strategic HPC infrastructure and services with an emphasis on improved coordination and a strong public value investment approach.

Recommendation 2: Strengthen the uptake by HPC users, in particular for commercial applications by industry, SMEs, and innovative companies and start-ups by strengthening the role of HPC intermediaries via public support.

Recommendation 3: Support (mainly via public support) HPC stakeholders (in particular HPC centres and intermediaries) in developing more commercially oriented business models based on the provision of secure and flexible HPC services and infrastructure.

Recommendation 4: Adapt existing financial instruments and explore the development of more dedicated financial instruments and blended instruments for the financing of HPC centres and to support the digitalisation of companies including HPC development and deployment.

Recommendation 5: Improve knowledge of, and access to, public financing instruments and financial advisory services for HPC stakeholders.

Latest News

-

ETP4HPC will be exhibiting at ISC 2024 and has invited 4 of its SME members to co-exhibit. Visit booth M21 and meet representatives of Cendio...

-

From 18 to 21 March, the ETP4HPC team was in Antwerp for the EuroHPC Summit, along with many of our members. We've created a short video to...

-

On 12 April we continue our tour of EuroHPC supercomputers with the HPC Vega system, hosted by IZUM in Maribor in Slovenia. Aleš Zemljak and Žiga...

-

We had to postpone the DestinE webinars, so in the meantime we decided to continue our popular series on EuroHPC systems. On 8 March, IT4I will...

-

At their meeting held just before the ETP4HPC Conference, our Steering Board elected the new ETP4HPC representatives at the EuroHPC Research and...

-

The second edition of the ETP4HPC Conference will take place on 13-14 February 2024 at the Van der Valk Hotel in Sassenheim-Leiden (near...

-

After LUMI in October, we will discuss on 26 January another of the three EuroHPC pre-exascale systems: LEONARDO, the supercomputer hosted and...

-

LEONARDO and Destination Earth are on the programme of the ETP4HPC webinars in 2024. We will start on 26 January with a webinar dedicated to...

-

All ETP4HPC members are cordially invited to our usual ‘end-of-the-year’ All-Members Call from 10am to 12 noon CET on 5 December. We'll...

-

Due to technical issues, we were unable to have the LUMI webinar initially scheduled on 15 September. We apologise for this last-minute cancellation....

-

Our association is run on a day-to-day basis by our Office staff, a virtual team distributed over Europe and working either from home or hosted by an...

-

Our association is run on a day-to-day basis by our Office staff, a virtual team distributed over Europe and working either from home or hosted by an...

-

15 September 11am CEST The EuroHPC system LUMI, located in Kajaani, Finland, is currently the fastest supercomputer in Europe and in...

-

The EuroHPC JU project Inno4scale has issued a call for proposals for “innovation studies” relating to algorithms for exascale computing –...

-

We've got you covered! We are planning a rich and varied programme of webinars from September onwards. In September we will welcome Pekka...

-

In March 2023 at the EuroHPC Summit, ETP4HPC organised a much appreciated session on Emerging Technologies for European HPC. To share it with as...

-

In 2023 the Teratec Forum moved to a new venue in Paris. But as usual ETP4HPC exhibited close to the Europa Village. ETP4HPC also...

-

ETP4HPC is exhibiting at ISC and has invited 4 of its SME members to co-exhibit. Visit booth A101 and meet representatives of BlockHeating,...

-

ETP4HPC is looking for two new people to strengthen its Office team: an SRA Technical Leader and an Office Manager. They both are...

-

Our last SRA webinar will address HPC System Software and Application co-design. Speakers Manolis Marazakis (FORTH) and Erwin Laure (MPCDF) will...

-

All attendees will tell you: the EuroHPC Summit 2023 was a great success! Despite the rainy weather in Göteborg, the atmosphere at the Summit was...

-

In 2023, ETP4HPC organised a full day conference on 8 March, prior to the annual General Assembly. Our members enjoyed this time dedicated to...

-

At our first in-person General Assembly since 2019, the ETP4HPC members elected their new Steering Board. We are excited to welcome 4 new...

-

In 2023, for the first time ever, ETP4HPC organises a conference open to all just before our General Assembly, in Sassenheim (near Amsterdam). Join...

-

Our first webinar in 2023 will cover Programming Environment and Mathematical Methods and Algorithms, two research domains from our SRA 5, our...

-

Registration is now open for the EuroHPC Summit 2023 that will take place 20-23 March 2023 in Gothenburg, Sweden. Attend to know all about...

-

EUMaster4HPC trains students, in an online and on-site format, on cutting-edge knowledge in HPC and HPC-related technologies taught by the best...

-

Last webinar of the year on 16 December 11am CET: don't miss it if you want to know more about our Strategic Research Agenda (SRA) for European...

-

ETP4HPC has been approached by ECMWF – a long-time member of our association – to provide a Strategic Technology Agenda (STA) for DestinE. Our...

-

Following the publication of the fifth edition of our Strategic Research Agenda (SRA), 2 webinars will introduce the SRA and focus on a selected...

-

We have kept you waiting for months with the publication of our thematic White Papers, now the full SRA 5 has arrived! With over 140 contributors...

-

ETP4HPC is a contributing partner of EUMaster4HPC, the European Master for HPC funded by the EuroHPC JU. Attend our 28 October webinar, organised...

-

8 July 11am CEST - The FF4EuroHPC project gives European SMEs the opportunity to use European high-end HPC services to develop innovative products...

-

The ETP4HPC team was at ISC 2022 in Hamburg. If you missed us, here is our photo album and a short overview. We had invited five of our SME...

-

Our ninth White Paper is ready - only one more to go until we are ready for the full SRA! It describes the success story of Modular Supercomputing...

-

The ETP4HPC Handbook of European HPC projects now is a website: etp4hpc-handbook.online. It offers many additional features, such as filters and...

-

This week, the two advisory groups of the EuroHPC JU elected their chairs at their first in-person meetings in Luxembourg. The RIAG is chaired by...

-

As CMOS scaling is facing increasing challenges to deliver performance gains by conventional means, a range of new unconventional architectures...

-

Our 7th White Paper is ready! Read it online or download it here>> Congratulations to the authors: Utz-Uwe Haus (HPE), Sai Narasimhamurthy...

-

This workshop aims to connect two inter-related ecosystems: HPC and Edge computing. ETP4HPC and Castiel have joined forces to explore what are the...

-

Want to know more on the challenges raised by a more flexible and responsive resource management for urgent decision support? We have invited the...

-

For many, the EuroHPC Summit Week 2022 in Paris was the first in-person conference since the Covid-19 pandemic started. The ETP4HPC Office and...

-

We were not able to meet you in person in 2021, so we decided to come to you in video for this overview of our activities, instead of our usual...

-

The EuroHPC Summit Week 2022 will take place in person from 22 to 24 March in Paris at the Cité des Sciences et de l'Industrie. This year it...

-

Heterogeneity is here to stay! Discover all about the Challenges and Opportunities it brings to HPC in the latest ETP4HPC white paper prepared by...

-

The fifth white paper prepared by our SRA team is out, and it is dedicated to the technical implications for HPC of supporting urgent decisions....

-

Students can now apply to EUMaster4HPC, the first pan-European Master for High Performance Computing (HPC). With funding from the EuroHPC Joint...

-

Join the European HPC community in Paris for a rich programme of plenary talks, scientific presentations and workshops. 22 March: EuroHPC...

-

The ETP4HPC webinar series is back in 2022 with new topics! We will start on 18 February (11am CET) with "GAIA-X - vision, implementation and...

-

The TCI initiative is pleased to welcome a new partner, EPoSS. EPoSS will extend the TCI’s scope of expertise to smart systems and integrated micro...

-

If you missed the session, don't miss the article! A summary of our Bird-of-a-Feather session at SC21 was published by HPCWire: "At SC21,...

-

10 December, 11am CET We have invited the authors of our White Paper Quantum | HPC. The presentation will focus on technology integration of...

-

Our online Bird-of-a-Feather session was held on 17 November. It gathered 37 attendees, including five of the ETP4HPC team. First, Franz-Josef...

-

The first call for proposals for the EuroHPC Joint Undertaking (EuroHPC JU) regular access mode is open. Researchers from academia, research...

-

This webinar will focus on the ETP4HPC white paper on sustainability and usability, authored by Pascale Rosse-Laurent, Francois Bodin and Andreas...

-

The fourth ETP4HPC white paper is dedicated to a new domain for us: Quantum Computing. The paper was prepared by our new SRA working group...

-

In 2021 ETP4HPC returns to its traditional European Bird-Of-a-Feather at SC21, with the session "Can fast be green? Opportunities and challenges...

-

And that's three! The third ETP4HPC white paper is available - and we won't betray a secret by revealing that a fourth White Paper is on the...

-

Our SRA workgroups have been extremely busy this summer! Two weeks after our first SRA white paper was released, another in the series is available....

-

Three speakers representing three major European HPC centres have accepted our invitation: Alison Kennedy (STFC Hartree Centre), Bastian Koller...

-

While preparing for the next edition of our Strategic Research Agenda (SRA), ETP4HPC is also working on a series of White Papers tackling technical...

-

The second white paper prepared by the 8 associations forming the Transcontinuum Initiative (TCI) is published! This paper prepared by Dirk Hartmann...

-

The new season of our webinars starts with the presentation of a use case analysed by the partners in the TransContinuum Initiative. Fast and...

-

The yearly Handbook prepared with the support of the HPC-GIG project features the complete list and details of 68 on-going EC-funded projects...

-

ETP4HPC organised on 26-27 July a vote among our full members to formally decide whether to join the new EuroHPC JU as a private member. The result...

-

How can SMEs develop innovative business opportunities and become more competitive by using high-end HPC services? How to apply to the FF4EuroHPC...

-

Using Graphcore IPU systems at the convergence of AI and HPC 29 June, 16:00 CEST ETP4HPC members Graphcore and Simula are joining forces to...

-

The month of June will be almost as busy as usual with events: ETP4HPC will be exhibiting at both the Teratec Forum (22-24 June) and ISC (24 June - 2...

-

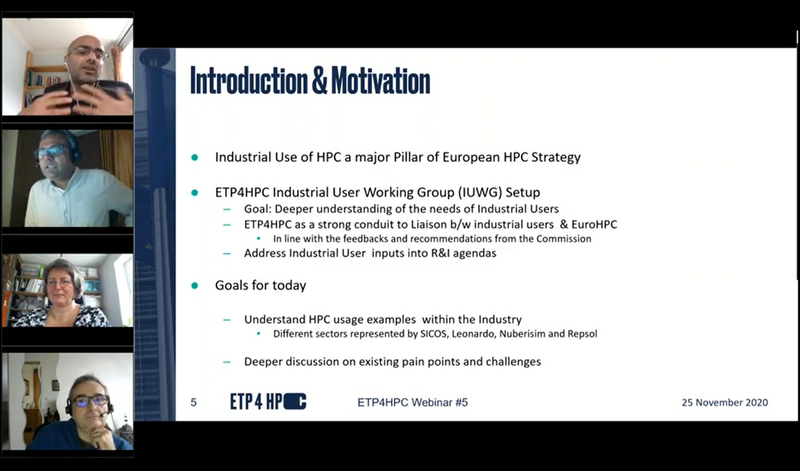

Fostering the use of HPC by the industry is one of the pillars of the European HPC Strategy implemented by EuroHPC. However, the needs of industrial...

-

ETP4HPC is proud to support the EVOLVE webinars, a series of short webinars that will be held over June and October by project EVOLVE (EVOLVE is one...

-

MeluXina, the new EuroHPC petascale system of Luxembourg, will operate from May 2021. The machine is an Atos BullSequana system, supported by the...

-

Fostering the use of HPC by the industry is one of the pillars of the European HPC Strategy implemented by EuroHPC. However, the needs of industrial...

-

You did not get it in your inbox? Subscribe at http://eepurl.com/gwYQWT ! In this issue discover our Annual Report, hear about the TransContinuum...

-

The EuroHPC Summit Week will be held from 22 to 26 March 2021, as a fully digital event. Register - free of charge - to attend a wide...

-

The ETP4HPC webinar series is back with new topics! We will start on 19 March (11am CET) with "In-memory computing for AI applications"...

-

This magazine-style report presents our organisation, our members and our activities throughout the past year: Our association New...

-

HiPEAC (High Performance Embedded Architecture and Compilation) published on 19 January the 8th edition of the HiPEAC Vision. This 228-page...

-

Our joint ETP4HPC-HiPEAC session will take place on 18 January 2021 at 3pm: Bringing the HiPEAC and ETP4HPC Communities together through the...

-

Our TCI partner the CLAIRE network provided an excellent introduction to AI in our 15 December webinar - while pointing out the areas of specific...

-

To pursue and extend the collaborative work started around HPC in the Digital Continuum, ETP4HPC is coordinating the TransContinuum Initiative. To...

-

In December we will explore Artificial Intelligence with our TCI partner CLAIRE, the Confederation of Laboratories for Artificial Intelligence...

-

If you missed our most attended webinar since we started webinars, here is your opportunity to catch up! On 25 November 2020, we had invited 4...

-

The key concept behind the FF4EuroHPC project is to demonstrate to European SMEs ways to optimize their performance with the use of advanced HPC...

-

The yearly Handbook prepared with the support of EXDCI-2 features the complete list and details of 50 on-going EC-funded projects related to HPC -...

-

Advancement in industrial use of HPC is one of the pillars of the European HPC Strategy implemented by EuroHPC. However, the needs of industrial...

-

One of the key challenges in HPC for the years to come is the development of the Digital Continuum, i.e. the integration of HPC and related...

-

One of the key challenges in HPC for the years to come is the development of the Digital Continuum, i.e. the integration of HPC and related...

-

Teratec Forum is going virtual, but we’ll be REALLY available for you there! The Teratec Forum will finally take place as a fully virtual event...

-

As of 24 September 2020, the EuroHPC JU is solely responsible for its operations and has the capacity to implement its own budget, under the...

-

Today, the Commission takes further steps in the Digital Decade agenda to strengthen Europe's digital sovereignty, as announced by President...

-

We have invited the HiPEAC Coordination and Support Action to present their activities and their ecosystem. ETP4HPC has a long-time collaboration...

-

The EuroHPC JU call for proposals H2020-JTI-EuroHPC-2020-02: Framework Partnership Agreement in European low-power microprocessor technologies...

-

It's the first time we have reached the 100 mark: the ETP4HPC Steering Board recently approved the application of EXAPSYS as an associated...

-

In our 2nd webinar we invited the 4 SMEs (Submer, NAG, Constelcom, Bright Computing) that were meant to exhibit on our ISC booth, and asked 5...

-

Today 22nd June, we should have been in Frankfurt on our ISC booth, hosting 4 of our SME members as co-exhibitors. We had several boxes of our ...

-

On 19 June, 2020, ETP4HPC held it first webinar, focused on our Transcontinuum initiative. It was also the opportunity for 3 new ETP4HPC members...

-

We will start with two webinars in June/July to share what we would normally have presented at ISC, and then as of September we will find our...

-

BDVA, in collaboration with ETP4HPC, is organising on May 5th an online workshop targeting the pilot test-bed projects of the ICT-11-2018-2019...

-

As planned in the EuroHPC Work Plan of the year 2020, the call for Advanced pilots towards the European exascale supercomputers is now open. This...

-

Our new Strategic Research Agenda and the related public call for comments, our 2019 Annual Report, the announcement of the 2020 EuroHPC calls, a new...

-

The EuroHPC JU has published an update of its Annual Workplan for 2020. Three calls related to the research and innovation programme are planned in...

-

The FocusCoE project is tasked with providing feedback about the needs and requests coming from industry that could be answered by the HPC Centres...

-

This Strategic Research Agenda (SRA) is the fourth High Performance Computing (HPC) technology roadmap developed and maintained by ETP4HPC, with the...

-

Our GA is cancelled as a precaution against the epidemic, but you can read about our activities in the Annual Report we released recently. Our...

-

See what we've been up to in 2019. Hear about our contribution to the EuroHPC RIAG. Have a sneak peek at the contents of the 4th edition of...

-

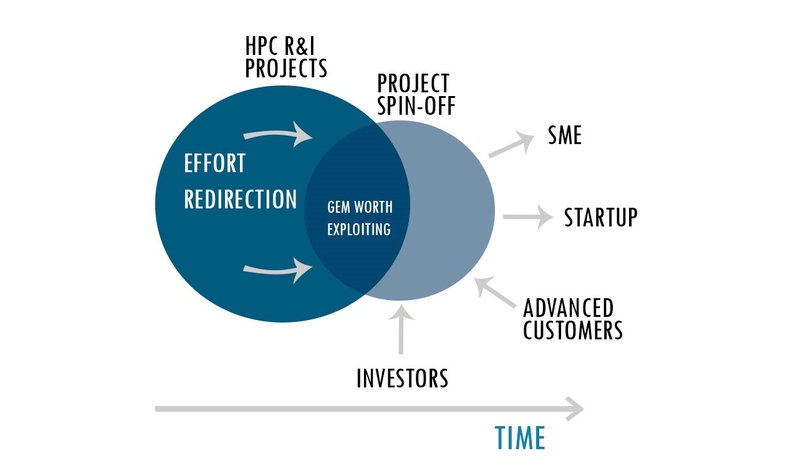

Last summer, EXDCI-2 launched its first call for spin-off initiatives (SPI), that aims to help EU funded R&I projects to exploit their novel...

-

This year again, the EuroHPC Summit Week (EHPCSW) 2020 will gather the main European HPC stakeholders from technology suppliers and HPC...

-

Read about our successful BoF session at SC19, mark the date of our coming General Assembly in your calendar, and start using the ETP4HPC online...

-

The ETP4HPC team was visibly present at SC19. See our photo album of the event! The new flavour of our BoF was unanimously appreciated: instead...

-

The European High Performance Computing Joint Undertaking (EuroHPC JU) is launching today a call for tender for the procurement of three world-class...

-

The contracts were officially signed in Strasbourg on 26 November, 2019. This means that the procurement process can now start for the 8 selected...

-

Download the PDF or get your printed copy at the ETP4HPC BoF at SC19. The yearly Handbook prepared with EXDCI features the complete list and...

-

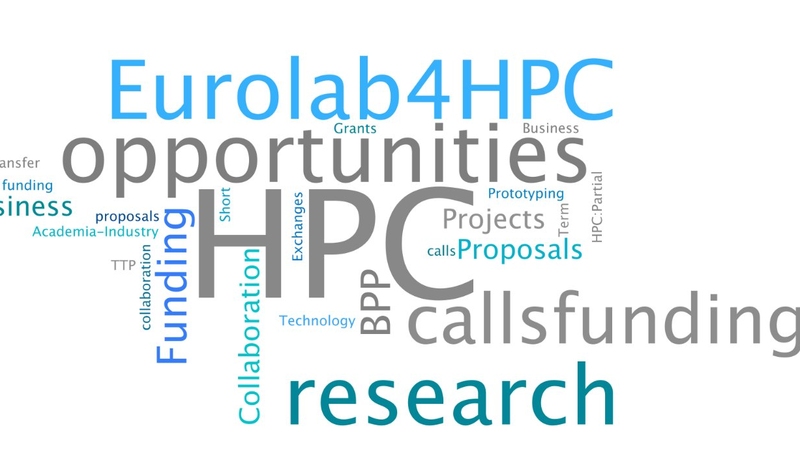

Eurolab4HPC opened 2 calls. The deadline for both is 31 October: Extra Call for Business prototyping Proposals for HPC To promote...

-

All you need to know on the EuroHPC calls published this summer in the September issue of our Newsletter. But also more about coming events...

-

Two calls for a total of 5 topics were issued on 25 July, 2019. ETP4HPC members, you can rely on your ETP4HPC network to find partners for those...

-

You are an industrial company using HPC for your operations? Join us and take an active part in shaping the European HPC research strategy. ETP4HPC...

-

Transitioning from the outcome of an HPC Research and Innovation project to a (successful) market product is often an issue. Not enough time, not...

-

Work on our Strategic Research Agenda, publication of our Blueprint, new members, actions towards industrial members, our presence at ISC, EHPCSW and...

-

The HPC community converged again to Frankfurt last June for ISC! ETP4HPC had increased its presence , with a larger booth that hosted 4 of our...

-

The EuroHPC JU has selected 8 sites for supercomputing centres located in 8 different Member States to host the new high-performance computing...

-

The EuroHPC Summit Week in Poznan closed a week ago, after several days of intense networking . The entire week was organised by PRACE, EXDCI-2 and...

-

In this document our experts delineate the high-level priorities for HPC technology for the years to come. It was prepared in collaboration with...

-

ETP4HPC in EuroHPC, new members, feedback from our General Assembly, coming events, our work on the new Strategic Research Agenda for European HPC...

-

On 5 April, our four members of the EuroHPC RIAG (Research and Innovation Advisory Group) were joined by three observers, and our chair Jean-Pierre...

-

At the ETP4HPC GA on March 18, 2019 in Sassenheim, Netherlands, Primeur Magazine interviewed three of our members: Fabrizio Magugliani from E4...

-

Pictures, short summary and pointers to more information for those who were unable to attend. Our 9th General Assembly was held in Sassenheim,...

-

Did you know that our members represent 23 countries? Did you know that nearly a third of our members are SMEs? It's all in our 2018 Annual...

-

The EuroHPC Summit Week (13-17 May) will be hosted by the Poznan Supercomputing and Networking Center. It is co-organised by PRACE, EXDCI-2 and...

-

On 11 March 2019 in Brussels, EuroHPC Joint Undertaking (EuroHPC JU) is organising an open information day to present the upcoming supercomputer...

-

The Vision workshop co-organised by HiPEAC and ETP4HPC at the HiPEAC conference in Valencia presented the highlights of different vision documents...

-

Missed us at ICT 2018 in Vienna on 4-6 December? Catch up here! Watch the slideshow, download the presentation. This research and innovation...

-

At ICT2018 in Vienna, the chairmen of ETP4HPC and AIOTI, the Alliance for Internet of Things Innovation, signed a Memorandum of Understanding to...

-

Another important milestone in the deployment of EuroHPC: their website is live. Visit https://eurohpc-ju.europa.eu to know all about the workings...

-

Our collaboration with the Big Data Value Association has materialized with this first White Paper entitled " The Technology Stacks of High...

-

The yearly BoF co-organised by ETP4HPC and EXDCI2 at SC has almost become an institution. For the fourth time in a row, we presented to the...

-

ISC introduced the Project Posters session in 2017. This session is a great opportunity for new European projects to present their ideas,...

-

The ETP4HPC steering board has been preparing the involvement of our association in the EuroHPC Joint Undertaking for many months. The General...

-

Read it online or get your printed copy at the ETP4HPC BoF at SC18. The yearly Handbook prepared with EXDCI features the complete list and details...

-

Our member Teratec held its first Open Day event on 2 October, 2018, on the Teratec Campus near Paris. The objective was to invite SMEs, students,...

-

Our traditional SC18 BoF organised jointly with EXDCI2 will take place Wednesday, 14 November from 5:15 to 6:45pm in room D-166. We know you are...

-

Are you interested in funding for Business Prototyping Projects in HPC? Short Term Collaboration Exchanges in HPC? Bilateral...

-

Thomas Skordas, Director "Digital Excellence and Science Infrastructure", explained in a recent post how the European Commission is ...

-

ETP4HPC is proud to confirm that we will be present at ICT 2018 in beautiful Vienna on 4-6 December. This research and innovation event will focus on...

-

Read about our recent work on ‘HPC Vision’, to define our priorities for the post-Horizon 2020 era, and get an overview of our participation in...

-

Missed our joint workshop with its impressive panel of speakers? Catch up here with our photo album of the event. The presentations are available...

-

Michael Ott (LRZ), leader of our Work Group on Energy Efficiency, organised a Workshop on "Energy Efficiency in HPC" as part of the...

-

You missed the European HPC Summit Week 2018 in Ljubljana from 28 May to 1 June? Have a look at the slideshow! ETP4HPC was very much part of this...

-

Discover how ETP4HPC helped boost the European HPC ecosystem in 2017: SRA, new members, working groups, events, convergence with Big...

-

Michael Ott (LRZ), leader of our WG on Energy Efficiency, is organizing a Workshop on "Energy Efficiency in HPC" as part of the European...

-

The new ETP4HPC Steering Board elected its board during its first face-to-face meeting in Munich (hosted by Partec). Chairman : Bull Atos /...

-

ETP4HPC is working on an HPC Vision document in order to influence the contents of the FP9 Programme and other related initiatives. The objective...

-

We would like to welcome the following organisations in our Association: Neovia – SME/Associated Member TS-JFL – SME/Associated...

-

ETP4HPC held its 8th General Assembly on 13th March 2018 at Intel Ireland. The main objective of the event was to elect a new Steering Board, which...

-

TETRAMAX opened a new call for Value Chain Oriented and Interdisciplinary Technology Transfer Experiments (TTX), deadline is May 31, 2018, 17:00...

-

TETRAMAX has issued a new newsletter (it includes a call with a deadline this month).

-

The EC has launched a consultation on the next Research and Innovation Programme - available here. The text of the EC's communication is...

-

These are: NEC (associated member), Heidelberg University (Research Centres - Full member) and Iceotope (Associated Member).

-

TETRAMAX focuses on the domain of customized low-energy computing for Cyber-physical systems and the Internet of Things within the framework of the...

-

Following the success of previous editions, EXDCI is pleased to announce an open call for workshops for HPC stakeholders (institutions, service...

-

The European Big Data Value Forum 2017, jointly organised by the Big Data Value Association and the European Commission, was held in Versailles,...

-

The 2nd Joint Workshop of BDVA and ETP4HPC took place on the afternoon of November 20th at Palais des Congrès, Versailles. The first technical...

-

The International Conference for High Performance Computing, Networking, Storage and Analysis (SC17) proved to be a great success this year. From...

-

Strategic Research Agenda (SRA 3) Released November 2017 and Public Call for Comments ETP4HPC as an industry-led think tank and advisory group of...

-

ETP4HPC took part in the ICT Proposers' Day in Budapest on the 9th of November 2017. Marcin Ostasz, ETP4HPC Expert, participated in a discussion...

-

The International CAE Conference took place in Vicenza on the 6th and 7th of November 2017. The Research Agorà, an area dedicated to the...

-

BDVA has announced the official publication of its Strategic Research and Innovation Agenda (SRIA). This publication is the 4th version of their...

-

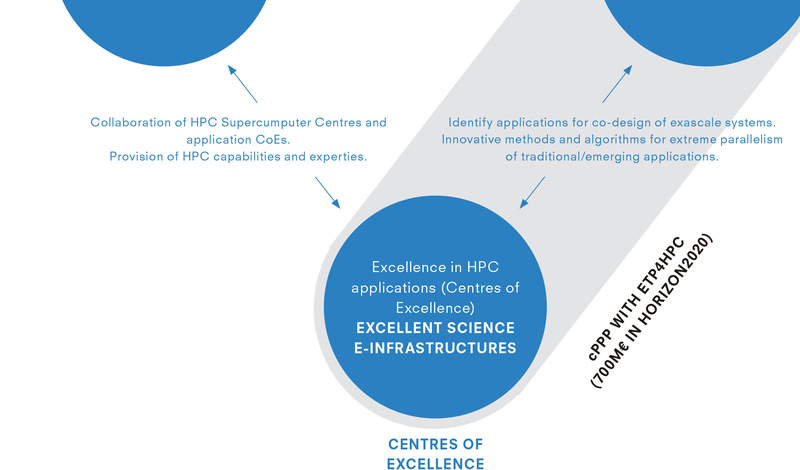

On the 29th of September the European Commission published a Mid-term Review Report concerning the Contractual Public private Partnerships (cPPP)...

-

A communications workshop took place on October 26th during the autumn Computing Systems Week session which HiPEAC organised in Stuttgart, October...

-

The 2nd JPI Oceans conference took place in Lisbon on October 26 (two years after the first JPI Oceans Conference held in Brussels in May 2015) where...

-

On the 27th of October 2017, the European Commission presented the final Work Programme for Horizon 2020, covering the budgetary years 2018, 2019 and...

-

The contractual Public-Private Partnership (cPPP) for High-Performance Computing held their eighth meeting in Brussels on October 25, where...

-

A workshop on the 'Strategic Research Agenda Presentation' took place on the 6th of October. Marcin Ostasz, a ETP4HPC expert was a...

-

We have finalised the 2017 Handbook - a professional publication, which will be distributed at our SC17 Birds-of-a-Feather session on European...

-

ETP4HPC is currently carrying out work on finalising its new Strategic Research Agenda (SRA 3), which is due to be released and distributed by the...

-

The submission of proposals to the two topics under call H2020-FETHPC-2017 closed on 26th of September 2017. A total of seventy proposals were...

-

The EXDCI project final conference took place within the Annual ACM Europe Conference 2017 that took place from September 7th to 8th at UPC,...

-

This networking event took place in the heart of Barcelona. The objective was to gather ETP4HPC members, EXDCI experts and selected stakeholders in...

-

PPI4HPC organised an Open Dialogue Event (ODE), which took place on September 6 to inform the market of the future joint procurement and to gather...

-

During a workshop organised by ETP4HPC, a number of ETP4HPC members were interviewed by Ad Emmen from Primeur Magazine. This workshop was organised...

-

ETP4HPC co-organised a technical exchange meeting with Big Data Value Association (BDVA) with the view of improving a common technical language...

-

This closed meeting took place at IBM, Zurich, where SRA working group leaders met to make a final review of the 3rd edition of the Strategic...

-

E-CAM - Centre of Excellence - Extreme-Scale State-of-the-Art Workshop took place on July 6-7, at CECAM-ES, University of Barcelona. The central goal...

-

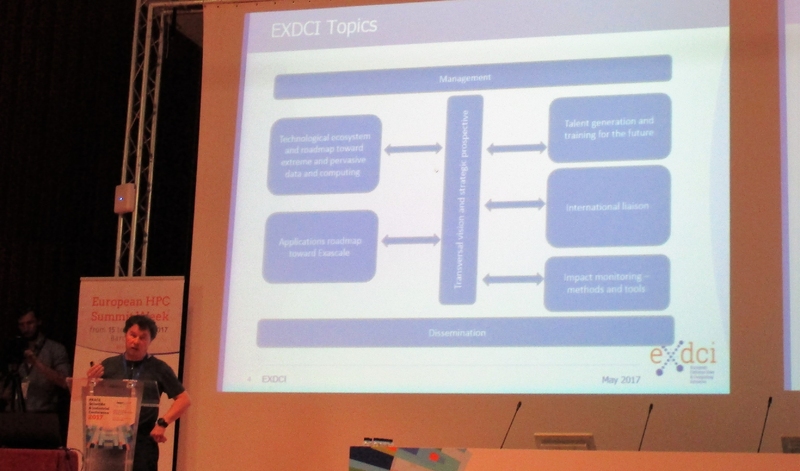

This is the agenda of the event. DAY 1 - a discussion on the current status of the EXDCI project and the preparations for its next round (EXDCI...

-

ETP4HPC is currently working on its new Strategic Research Agenda (SRA 3), which will be completed by the end of Sept 2017. The ETP4HPC Strategic...

-

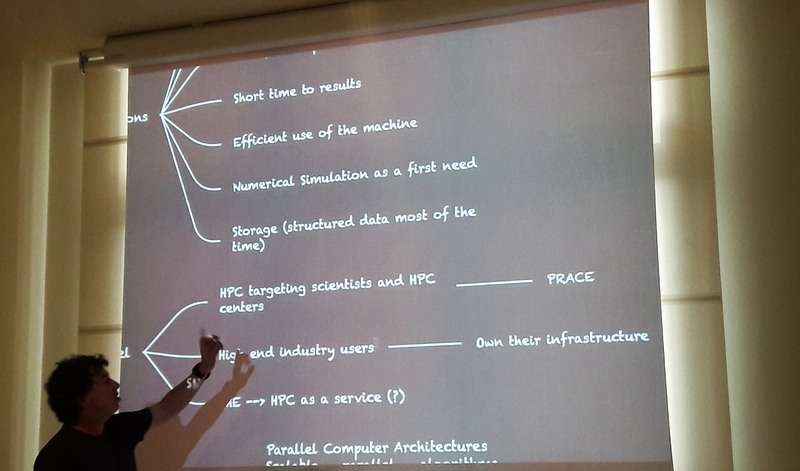

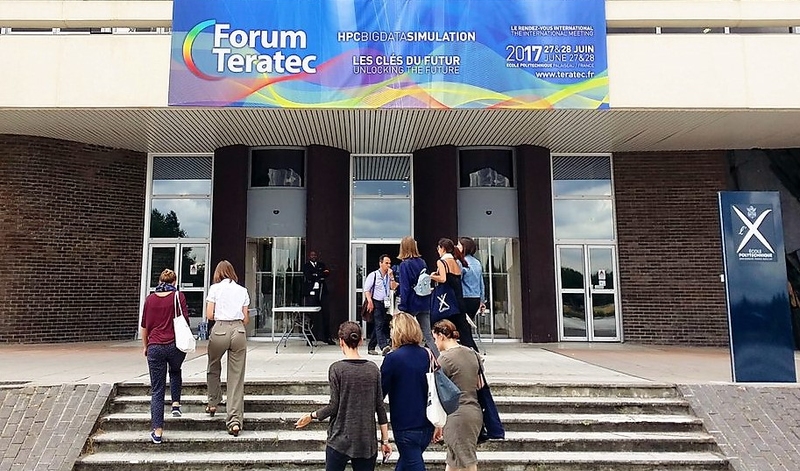

ETP4HPC participated in this year’s Teratec 2017 Forum - its 12th edition - between June 27th and 28th at Ècole Polytechnique in Palaiseau,...

-

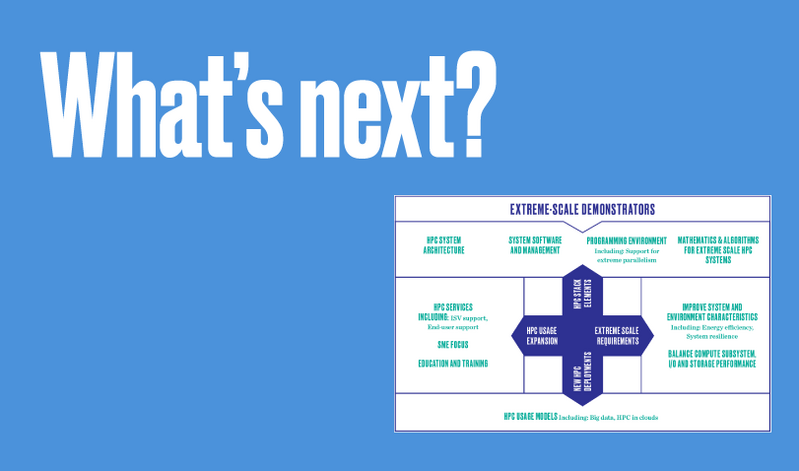

ETP4HPC organised a workshop, in conjunction with ISC 2017, on SRA 3 and Extreme-scale Demonstrators, with industrial users on the 22nd of June, in...

-

The 32nd edition of the ISC High Performance set a new record this year with 3200 HPC enthusiasts registered from 60 countries, a three percent...

-

EOSC Summit: The European Open Science Cloud – The New Republic of Letters During the first edition of the EOSC Summit, Carlos Moedas, EC...

-

Innovative Enterprise Malta 2017 is a conference organised by the European Commission in collaboration with the Maltese EU Presidency, in particular...

-

A mini-workshop on “Preparing for PRACE Exascale Systems” within the WP7 F2F meeting was held at Forschungszentrum Jülich (FZJ), Germany, on...

-

ETP4HPC hosted a SRA 3 Workshop ‘Developing SRA Strategic Analysis and High-Level Technical Analysis’ during the second edition of the European...

-

ETP4HPC organised a workshop on behalf of EXDCI during the 2nd edition of the European HPC Summit Week, which was hosted by Barcelona Supercomputing...

-

The contractual Public-Private Partnership (cPPP) for High-Performance Computing held their seventh meeting during the European HPC Summit Week at...

-

PRACEdays17, the fourth edition of the PRACE Scientific and Industrial Conference, took place from Tuesday 16th until midday Thursday 18th during the...

-

The EXDCI held a workshop on the opening day of the 2nd edition of the European HPC Summit Week (EHPCSW17) - the premier networking forum for High...

-

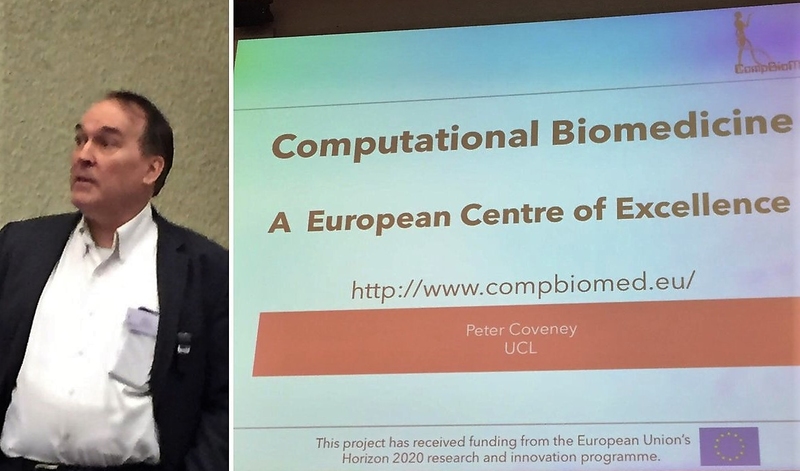

The CompBiomed meeting on Cloud and HC in Biomedicine was intended to provide a forum for users from academia, industry and healthcare sectors to...

-

The European HPC ecosystem event: this second edition offers a wide variety of workshops covering a number of application areas where supercomputers...

-

The 39th ORAP Forum: 'Emerging and Future Architectures for HPC in the World // HPC Input-Output and Storage', took place on the 28th of...

-

For the details of the process of SRA 3, please visit: http://www.etp4hpc.eu/en/sra-2017.html The ETP4HPC Strategic Research Agenda (SRA) is our...

-

The preparation of the FET Work Programme 2018-2020 under H2020 started in the beginning of 2016 with various inputs been collected, mainly during...

-

"Europe as a global player in High Performance Computing" This event was organised as part of the sixty years' celebration of the...

-

Study visit to Brussels on Big Data for Transformation of the Industry, March 21-22, Brussels A study visit was organised by the Polish National...

-

ETP4HPC launched their new visual identity during their 7th General Assembly on the 21st of March in Munich. This new branding, which was designed...

-

ETP4HPC’s 7th General Assembly was held on 21st of March to which all members were invited. IBM hosted this event at the new Watson IoT Center in...

-

Presentations from this SRA 3 Kick-off can be consulted here. ETP4HPC organised a Strategic Research Agenda (SRA) kick-off meeting for their...

-

On the occasion of the 25th PRACE Council Meeting in Amsterdam, the PRACE Members ratified a Resolution to proceed with the second phase of their...

-

ETP4HPC has launched a new round of networking, enabling our members and HPC stakeholders to collaborate together. We recognise the need for...

-

The Big Data and Extreme-Scale Computing (BDEC) held their 5th closed workshop from March the 8th to the 10th in Wuxi, China. BDEC brings together...

-

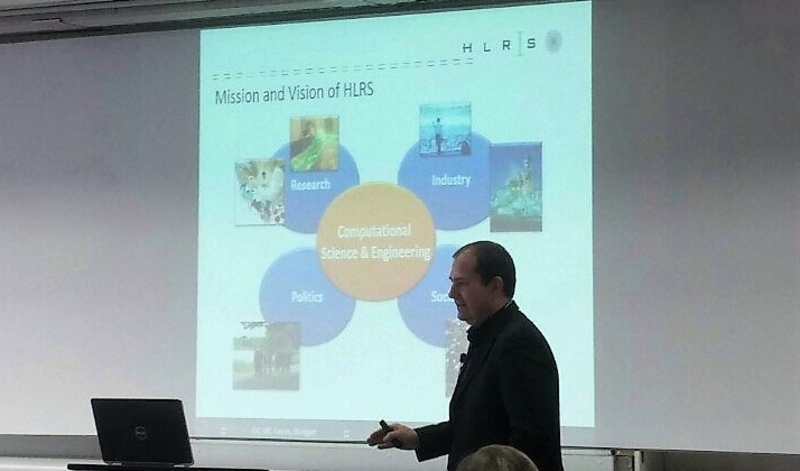

The 64th HPC User Forum took place at HLRS/University of Stuttgart, between February 28th and March 1st, with more than 100 attendees. IDC, in...

-

The ETP4HPC SME Working Group met on the 7th Feb 2017 (a workshop organised by ClusterVision in Haarlem) to discuss its strategy for the coming...

-

The 1st European Stakeholder Forum on Digitising European Industry, took place at the Grand Hall in Kokereiallee, Essen, between the 31st of January...

-

The “ARM - On the Road to HPC” event, which was hosted by Mont-Blanc, a European Exascale project, and coordinated by Barcelona Supercomputing...

-

HiPEAC’s domain (High Performance and Embedded Architecture and Compilation) – computers, programmable systems, processors, microcontrollers etc...

-

ETP4HPC was invited to join the Round-table on Future FET Flagships, which took place in Brussels on December 15th, 2016. The initiative of this high...

-

During ETP4HPC's last Steering Board meeting, Jean-Pierre Panziera was elected as Chairman of the ETP4HPC to replace Jean-François Lavignon who...

-

ETP4HPC is working on a draft for the proposal of the next (2018-20) EC Work Programme. This document will be delivered to the European Commission in...

-

The BDVA Summit 2016 took place in Valencia from November 29th to December 2nd 2016 with ETP4HPC being represented at the summit by Marcin Ostasz,...

-

The International Conference for High Performance Computing, Networking, Storage and Analysis (SC16) has been a hive of activity since November 13th...

-

The contractual Public-Private Partnership (cPPP) for High-Performance Computing held their sixth meeting at Beaulieu, Brussels, on November 8th,...

-

ETP4HPC was invited to E-CAM Centre of Excellence's General Assembly in Saclay on November 7th, to give an overview of the European HPC Landscape...

-

The International CAE Conference 2016 This year’s annual International CAE Conference took place on September 17-18 in Parma. This flagship for...

-

During this new bi-annual ORAP meeting, with more than 100 attendees widely spanning the French HPC community, Dr. Nominé from CEA & ETP4HPC Office...

-

CompBioMed is a new user-driven Centre of Excellence (CoE) in Computational Biomedicine, which nurtures and promotes the uptake and exploitation of...

-

Incheba Conference Center During the ICT Proposers’ Day 2016, Marcin Ostasz, ETP4HPC Office expert/BSC, took part in the panel discussion,...

-

Dr. Gustav Kalbe, Head of the new EC HPC & Quantum Computing Unit, met ETP4HPC on the occasion of his BSC visit. He joined the steering board...

-

The Big Data Value Association (BDVA) assisted at several meetings at Barcelona Supercomputing Center (BSC) from September 21-23. Over these three...

-

ETP4HPC facilitated a workshop on Extreme-scale Demonstrators (EsDs) during the second day of the EXDCI Technical Meeting held at Barcelona...

-

The European Extreme Data & Computing Initiative (eXDCI) held a technical meeting at Barcelona Supercomputing Center, was facilitated by François...

-

Centre Albert Borschette, Brussels The Chair of ETP4HP, Jean-François Lavignon, attended as an observer, the Round-table on Digitising European...

-

If you were unable to attend Teratec 2016 Forum nor attend all of the plenary sessions, you may now view them online...

-

We have created a message board on our website where announcements by our Members are posted. The Office of ETP4HPC moderates the contents of the...

-

The European Commission has opened a public call for applications to extend membership of the high-level expert group on quantum technologies to...

-

The European Exascale Projects team published a new report, which summarises the results from the last five years of research. This report...

-

Jean Gonnord, Vice-chair of ETP4HPC, was awarded the “personnalité de la simulation 2016” (2016 Simulation Personality) Trophy by Usine Digitale...

-

ETP4HPC participated in this year’s Teratec 2016 Forum - its 11th edition - between June 28th and 29th at Ècole Polytechnique in Palaiseau,...

-

ETP4HPC held a workshop (full day) ‘Outlining EsD System Characteristics’ – the 2nd EsDs discussion - at the ISC’16 on the 23rd of June in...

-

Consultation closed on Mathematics for Horizon 2020 next Work Programme The ‘Open consultation on Mathematics for horizon 2020 next Work...

-

ETP4HPC at ISC’16, 20–22 June, Frankfurt ISC’16 got off to a great start on Monday afternoon, where booths both small and big - 146...

-

ETP4HPC participated in the Big Data and Extreme-Scale Computing (BDEC) 4th closed workshop, on 16 & 17 of June, in Frankfurt. BDEC brings together...

-

ETP4HPC has two new working groups, which are in the process of kicking off. These two new groups are: the HPC Software working group which will be...

-

ETP4HPC attended the fifth meeting of the cPPP Partnership Board on the 11th of May 2016 in Prague, where EC representatives, the Centres of...

-

May 26-27, 2016, Brussels "Today we established important milestones for creating a truly digital single market in the EU to facilitate...

-

'Europe is in the middle of an economic revolution, and this revolution is digital. By being able to process the current explosion of data, High...

-

ETP4HPC held their Extreme-scale Demonstrator Workshop on the 12th May 2016 during the last day of the European HPC Summit Week in Prague. This...

-

During this morning's session of the 2nd day of PRACE DAYS 16, at the European HPC Summit Week 2016, Prague, Jean-François Lavignon gave his...

-

The European HPC Summit Week 2016 started today, May 9th, in Prague, and will continue until Thursday 12th. The summit week started with the EXDCI...

-

This week the Commission presented its blueprint for cloud-based services and world-class data infrastructure to ensure science, business and public...

-

Mateo Valero, Director of Barcelona Supercomputing Center, makes a pledge for developing a strong HPC ecosystem a week before the EU Commission...

-

think.BDPST Conference, March 8-10, 2016, Budapest The Antall József Knowledge Centre in cooperation with the Ministry of Foreign Affairs and...

-

Pan European Networks - Issue No. 18 Jean-François Lavignon, ETP4HPC chairman, outlines in his article how this industry-led association is...

-

CNRS, Michel-Ange, Paris The 37th ORAP Forum took place in Paris this week with more than 100 participants. This Forum devoted its first half...

-

ETP4HPC General Assembly, 15th March 2016, Barcelona ETP4HPC held its sixth General Assembly on 15th March 2016 at which all members of the...

-

The European Commission has launched an open consultation in the context of preparation of the next Horizon 2020 e-infrastructure Work Programme...

-

January 14-15, 2016, Brussels. The Data Value Chain Unit of the European Commission organised an Information and Networking Days on Horizon 2020 Big...

-

The European Commission has opened the following call for comments ‘Open consultation on Mathematics for Horizon 2020 next Work Programme’ which...

-

HiPEAC’s Conference took place from January 18 to 20, 2016, Prague, Czech Republic ETP4HPC’s chairman, Jean-François Lavignon, was an invited...

-

Public Call for Comments on ETP4HPC Strategic Research Agenda December 2015 Following the release of the ETP4HPC Strategic Research AgendaTHE...

-

This year’s Supercomputing Conference (SC15) in Austin, Texas, broke exhibit and attendance records. ETP4HPC co-organised a Bird-of-a-Feather (BoF)...

-

Strategic Research Agenda Update Released November 2015 ETP4HPC as an industry-led think tank and advisory group of companies and research centres...

-

High-performance computing (HPC) is one of today’s most important priorities. There is an article written by Leonardo Flores Añover and Dr....

-

Horizon 2020 (The EU Framework Programme for Research and Innovation) writes about how to make High-performance computing happen in...

-

The recently launched project EXDCI ‘European eXtreme Data and Computing Initiative’ has the mission to coordinate the development and...

-

The ICT15 event in Lisbon, took place over three days and attracted more than 5,700 participants. It was comprised of a number of parallel...

-

This year’s 31st edition of the CAE Conference, which took place in Pacengo del Garda (Verona, Italy), is an influential, annual flagship for...

-

Why do supercomputers matter for your everyday life? High performance computing is a strategic tool for science, industry, and society. There is an...

-

ETP4HPC General Assembly 29th September 2015, Rome 5th October 2015 ETP4HPC held its third General Assembly on 29th September 2015 in Rome,...

-

Following ETP4HPC General Assembly, September 29th in Rome, ETP4HPC and PRACE joined forces at EXDCI* HPC Workshop in Rome. This first Workshop...

-

ETP4HPC was invited to take part in a panel on “Service orientation to data and high-performance computing infrastructures” track of this event,...

-

ETP4HPC was at the International Supercomputing Conference in Frankfurt between the 13th & 15th of July. At booth #714 members and visitors could...

-

ETP4HPC participated once again in this year’s Teratec Forum, June 23th & 24th at Ecole Polytechnique in Palaiseau, France. Teratec Forum is one...

-

Our Strategic Research Agenda (SRA) is being updated in 2015. For that reason, ETP4HPC organised a HPC End-User Workshop on 22nd June 2015 in...

-

ETP4HPC took part in the first summit of BDVA (Big Data Value Association, http://www.bdva.eu/) on 16-18 June 2015 in Madrid, following an invitation...

-

The BigStorage European Training project is looking for 15 PhD Students to fill exciting opportunities to gain in depth skills cross cutting HPC Data...

-

The third workshop on Big Data and Extreme-scale Computing (BDEC) funded by NSF, DOE and the European Commission (through the EESI project,...

-

ETP4HPC organised a sucessful BOF session Towards European Leadership in HPC (Wednesday Nov. 18th) during SuperComputing 2014 conference in New...

-

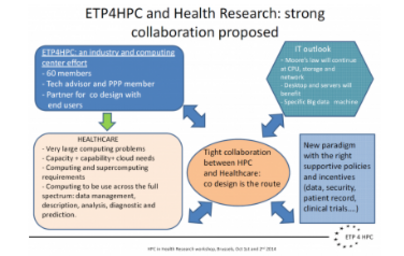

High Performance Computing (HPC) has emerged as a crucial technology in health research allowing fast advances in a series of areas. In particular,...

-

ETP4HPC was present at the Teratec Forum at Ecole Polytechnique, Palaiseau (France), the 1st and 2nd of July 2014. We had the booth Number 10 and...

-

Booth 923 at the exhibition allowed visitors to learn more about ETP4HPC, what we do and our plans for a strong HPC ecosystem that serves science,...

-

Marcin Ostasz, from ETP4HPC Office and Barcelona Supercomputing Center, presented the High Performance Computing Public Private...

-

Within the European arena there exists an array of provisions for Education and Training (E&T) in the field of High Performance Computing (HPC), to...

-

ETP4HPC has been asked by the EC to prepare input for the next round of FETHPC calls (2016/17). We have set up a Working Group to formulate a...

-

Members of ETP4HPC were invited to participate in a new ETP4HPC Working Group, with an aim to prepare the ETP4HPC position on the contents of the...

-

The PRACE Scientific and Industrial Conference welcomed ETP4HPC and was the occasion of rich and vivid interactions about HPC value and ecosystem,...

-

Forschungszentrum Jülich as the leader of the HBP’s High Performance Computing Platform subproject conducts a Pre-Commercial Procurement (PCP) for...

-

This Info Day was the first public event within the charter of the PPP on HPC. On December 17th, 2013, ETP4HPC, the European Technology Platform...

-

http://www.icri2014.eu/sessions/plenary-session-3-innovation-potential-research-infrastructures

-

Representatives of Daimler, Porsche, BMW, VW, Renault, Valeo, PSA, and Faurecia and that of DG-CONNECT, ETP4HPC and PRACE met on 1st April 2014 in...

-

The 1st Optical Interconnect in Data Centers Symposium is organized by EPIC and the EU project PhoxTroT. The symposium is focused on...

-

“The workshop series on Big Data and Extreme-scale Computing (BDEC) is premised on the idea that we must begin to systematically map out and...

-

Dr. Jose Baldasano, head of the BSC’s Earth Sciences Dpt., represented ETP4HPC at this occasion. Find out more on this event here.

-

The European Commission has published a call to operate a project that will coordinate the European HPC Strategy. The aim of the project is to...

-

ETP4HPC took part to the HiPEAC conference in Vienna. HiPEAC is the European Network of Excellence on High Performance and Embedded Architecture and...

-

04 February 14 – ETP4HPC now has five Work Groups up and running, on topics related to the ecosystem development in the wider sense. – Education...

-

Brussels, 19th of December 2013. ETP4HPC participated in a cross-ETP workshop in Brussels, organised by the Policy Development for Industrial...

-

Brussels, 17th of December 2013. ETP4HPC, the European Technology Platform (ETP) in the area of High-Performance Computing (HPC) signed an Agreement...

-

This PCP will be a multi-country and multi-partner joint effort, implemented by a consortium composed of several partners of PRACE (CINECA (Italy);...

-

Competitive call for HPC-Cloud-based Application Experiments for the FORTISSIMO project The Fortissimo project (FP7 contract 609029) is funding a set...

-

Venue and date: Sheraton Brussels Airport Hotel Wednesday, 18th December 2013 (10h30 to 16h00 CET) Full information leaflet available for download at...

-

ETP4HPC has just closed down their booth at ICT13 in Vilnius. The EU driven digital agenda event was the right place to be since we engaged in many...

-

ETP4HPC is actively engaging in with the European Community. The EC has listed ETP4HPC among the official European Technology Platforms in ICT...

-

Leipzig, 20 June 2013. At the breakfast event, the ETP4HPC presented an overview of the progresses obtained so far. The ETP panel introduced to the...

-

The ETP4HPC was present at ISC13 with its own booth (number 700). Breakfast event European Technology Platform for High-Performance Computing...

-

HPC users from different companies gathered together with ETP4HPC members at the Barcelona Supercomputing Centre for a workshop in the...

-

VP Neelie Kroes answered by confirming the alignment of the propositions with the implementations of the Commission strategy for HPC and positively...

-

Event description SC12 – The Supercomputing Conference. Boosting European HPC value chain: the vision of ETP4HPC, the European Technology Platform...

-

This time the discussion was cantered around finding KPIs for HPC in Europe starting from a broad SWOT analysis. The other contribution was...

-

The objective of the meeting was twofold: • the ETP4HPC to present the current contents of their Strategic Research Agenda work • to collect...

-

The ETP4HPC representants stressed the economic impacts of the HPC technologies and the window opportunity to expand the position of European players...

-

It was agreed that what the ETP intended to tell the EU was centered on the strategic impact of the HPC supply chain on the European economy, the...

-

Some small changes were decided for the ETP4HPC bylaws. Another important subject discussed was the preparation of the SRA (strategic reaerach...

-

The meeting was successfully in identifying the main ideas about the strategic priorities for HPC in Europe and in setting the principles on which...

-

HPC is an indispensable instrument to resolve problems of highest complexity that require extremely large and efficient computational and storage...

.png?&w=1200&h=706&zc=1&q=100&f=png)

.png?&w=800&h=471&zc=1&q=100&f=png)

.jpg?&w=800&h=471&sx=0&sy=62.02&sw=1200&sh=705.88&q=100)

.jpg?&w=800&h=471&sx=20.71&sy=232.99&sw=2283.29&sh=1343.11&q=100)

.jpg?&w=800&h=471&zc=1&q=100)

.png?&w=800&h=471&zc=1&q=100&f=png)

.jpg?&w=800&h=471&sx=0&sy=2.51&sw=1117&sh=657.06&q=100)

.jpg?&w=800&h=471&zc=1&q=100)

.png?&w=800&h=471&zc=1&q=100&f=png)

.jpg?&w=800&h=471&sx=0&sy=63.88&sw=2369&sh=1393.53&q=100)

.png?&w=800&h=471&zc=1&q=100&f=png)

.jpg?&w=800&h=471&sx=0&sy=15.95&sw=887&sh=521.76&q=100)

.jpg?&w=800&h=471&sx=0&sy=40.19&sw=1049.64&sh=617.43&q=100)

.jpg?&w=800&h=471&sx=0&sy=15&sw=350&sh=205.88&q=100)

.jpg?&w=800&h=471&sx=60&sy=0&sw=180.2&sh=106&q=100)

.jpg?&w=800&h=471&sx=2&sy=22&sw=360.4&sh=212&q=100)